270 days ago

USDC as a Gas Token is live on Gelato Arbitrum Orbit Chains!

Earlier this year, Arbitrum introduced custom gas tokens to its Arbitrum Orbit chains, allowing them to charge gas fees using any ERC20 token to build native onchain economies.

Earlier this year, Arbitrum introduced custom gas tokens to its Arbitrum Orbit chains, allowing them to charge gas fees using any ERC20 token to build native onchain economies.

Now, Circle’s USDC is supported as a gas token on Arbitrum Orbit chains!

Gelato has made this feature available from day one of its launch, so you can launch your Arbitrum Anytrust L2 & L3s and chain today using Circle’s USDC as a gas token.

Simplifying Chain UX with USDC as a Gas Token

Using USDC as a gas token improves convenience, stability, and accessibility. With more L2 and L3 chains, there's a push for simpler user experiences. USDC reduces friction and improves retail app user experience with stable, easy payments.

USDC as a gas token is especially useful for chains with retail apps that already charge fees in USDC. It can be utilized in various areas, including payments, exchanges, real-world assets, social apps, and more.

What Does It Mean for Orbit Chains Launching on Gelato?

The integration of USDC as a gas token aligns perfectly with the launch of Orbit Chains on Gelato, enhancing the user experience in several ways.

Easier Payments

Using USDC as a gas token makes orbit chains launching on Gelato convenient. Users can pay transaction fees with one of the most popular stablecoins, eliminating the need to hold multiple tokens for gas fees.

Enhanced Stability, Less Gas Price Volatility

USDC offers price stability, being pegged 1:1 to the US Dollar. This stability is crucial for users and developers, providing a predictable and reliable way to cover gas fees. Supporting USDC as a gas token means there is no concern about ETH price volatility impacting transaction costs.

Increased Liquidity and Accessibility

With over $1.6 billion in native USDC currently on Arbitrum, supporting USDC as a gas token lowers the barrier to entry for new projects on Arbitrum Orbit chains. USDC is a staple in the crypto community, and its use as a gas token makes it easier for users to engage with the Arbitrum ecosystem without needing to convert their assets.

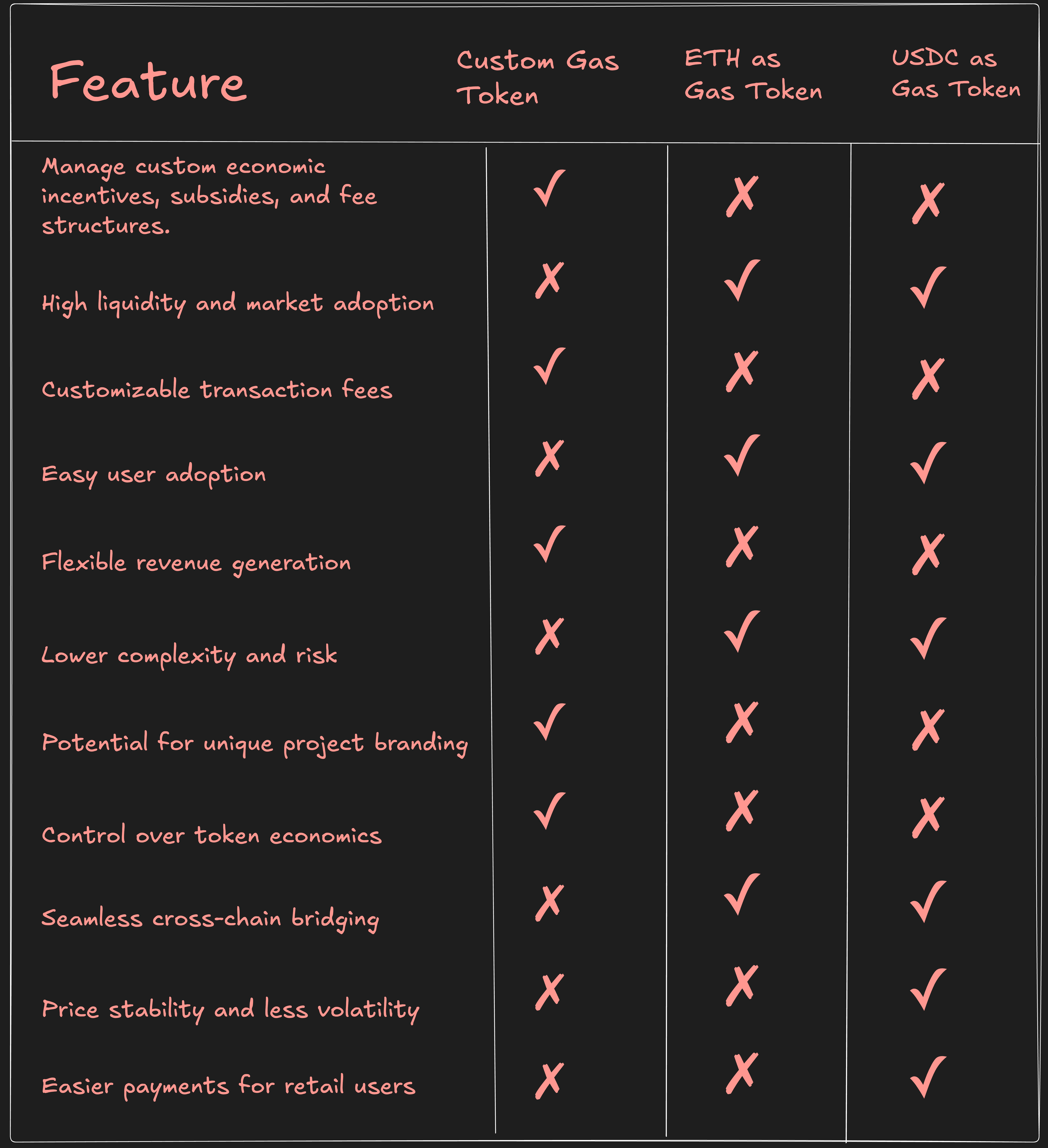

Comparing Gas Token Options

Choosing the Right Gas Token for Your Chain

When selecting a gas token for your chain, there are several pros and cons to consider. A custom gas token allows projects to create unique on-chain economies and offers better control over incentives and rewards. However, this flexibility can come with liquidity challenges and added complexity.

On the other hand, opting for Ethereum as your gas token gives you access to vast liquidity and a large user base, while also ensuring smooth interoperability within the Ethereum ecosystem. However, it limits your ability to customize token economics, such as fees and incentives. So, while you gain connectivity, you might sacrifice some flexibility.

For retail applications that already charge fees in USDC, choosing USDC as your gas token is a great fit. It offers stable and predictable transaction costs, making payments straightforward. However, similar to Ethereum, it also comes with limited flexibility in terms of fees and token economics.

Ultimately, the best choice depends on your project’s specific needs and priorities. Balancing accessibility, stability, and customization will help you find the right gas token for your chain.

Deploy your Arbitrum Orbit chains on Gelato, choosing from USDC, ETH, or a custom gas token.